We are all about to make a some very important decisions. On Tuesday, November 8th, we will elect the next President of the United States, a U.S. Senator to represent Louisiana, and, depending on where you live, representatives and judges too. What you may not know is that there are some pretty important state and local measures on the ballot as well.

We are all about to make a some very important decisions. On Tuesday, November 8th, we will elect the next President of the United States, a U.S. Senator to represent Louisiana, and, depending on where you live, representatives and judges too. What you may not know is that there are some pretty important state and local measures on the ballot as well.

Before we dive in, please check your voter registration status and your polling location at the Caddo Parish Registrar of Voters (caddovoter.org).

Beyond the leadership roles that will be voted on, there are six (6) proposed amendments to the Louisiana State Constitution including everything from rules on who may serve as Registrar of Voters to tax deductions and the ability for the state to manage funds to cover deficits.

To find out some non-partisan information, including pros and cons of each constitutional amendment, check out the Public Affairs Research Council of Louisiana’s in-depth breakdown of the issues, one by one. It’s pretty comprehensive and should at least provide anyone reading it with a starting place for consideration. Read it here (parlouisiana.org).

However, there is another vote on the ballot from the city of Shreveport that hasn’t received much discussion: the cryptically named “City of Shreveport – 1/4% S&U – CC – Perp.” This public vote is the result of a call for a special election by the Shreveport City Council in Resolution 108A of 2016 (which coincides with the national and state elections) to “authorize the renewal and collection of the one-fourth percent sales and use tax…” (read the full text here).

This 1/4% sales tax, which is already in effect as a temporary measure, is expected to garner nearly $11 million dollars per year, subject to fluctuations in budgets. The proceeds of which (after the cost of collections and administration) will be “dedicated and used solely and exclusively for salaries, benefits, equipment, and personnel for the Police and Fire Departments of the City of Shreveport.” It would become effective January 1, 2018. But, with little to no context to what this vote is about in the local media, we reached out to City Council District B’s Jeff Everson for an explanation of why this is on the ballot and what it means.

“[City of Shreveport – 1/4% S&U – CC – Perp.] is a sales tax that already exists and it is dedicated to salaries, benefits, equipment, and training for Shreveport Police and Fire Departments,” Everson explained. “If it passes on the ballot this election, it will become permanent. If it doesn’t pass it will still exist for a year and then have to be voted on again next year.”

The council has pushed for this vote to be made this year because voter turnout is expected to be high due to the national election. Everson said they could have waited until 2017, but the turnout is expected to be lower.

Shreveport citizens have seen tax increases recently. It’s no secret that tax initiatives remain unpopular with voters, especially so with the recent tax hikes. But, as Everson stated, the proposal is about whether or not to make an existing tax permanent instead of voting on it regularly. Before you vote, let’s consider some of the things funded by this tax, and what permenancy might mean.

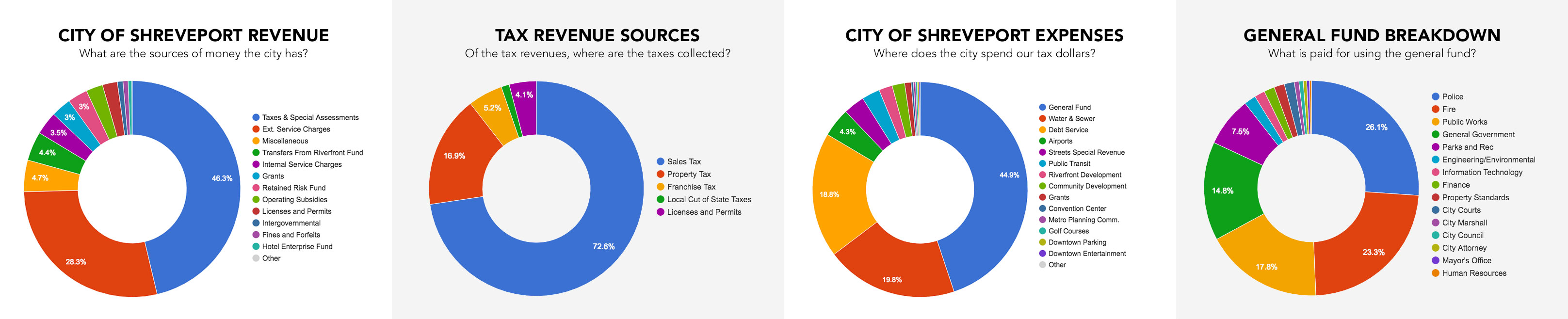

First, let’s look at the general fund of the City of Shreveport. The total operating budget is nearly half a billion dollars ($491 million to be exact). The city’s General Fund is $227,117,900, of which SPD receives $59,251,700 and SFD receives $52,824,100 or over $112 million combined for Fiscal Year (FY) 2016. That’s roughly half the city’s General Fund being spent on public safety and is roughly equal to the amount of sales tax collected by the city annually, which is pegged at around $120 million. For comparison, only $28 million is collected from property taxes.

Yet with all that cash in the budget, the city operates on the razor’s edge, expecting to have only $6 million cash on hand in the general fund at the end of FY2016. That close margin makes it very hard to take care of things like added infrastructure and reorganization of services caused by sprawl and new developments when it comes time to collect on the city’s bills.

For example, this year Shreveport Police department has finally sprung for 90 new marked vehicles to replace an outdated fleet to the tune of $3.5 million.

Shreveport Fire Department faces similar challenges as the vehicle fleet is turned over, replacing old vehicles with new ones, to the tune of over $15 million through 2019; Shreveport Fire is also looking ahead to relocation of stations, some of which have become “virtually ineffective,” due to the city’s “annexation and development at its periphery” according to the Shreveport Fire Department’s review by the Property Insurance Association of Louisiana (PIAL).

Changes to the city’s needs have necessitated nearly 100 additional positions in SPD and SFD since 2003, which appear to largely consist of uniform service officers for SPD as of late.

While some of the budgets of these public safety organizations come from various external sources, the Fire Insurance Premium Taxes, for example – the reality is that a large chunk of their funds come from the taxes collected on sales and use, which is what this proposition is all about (whether or not to make something we are already doing permanent).

If we vote YES, then it becomes a permanent tax, which would simply mean it would take another law to change it, preventing it from sunsetting on a regular basis. This would mean the city could reasonably count on this source of income.

If we vote NO, nothing changes immediately, but another special election will be called in 2017 asking citizens to either renew the existing tax that is set to sunset next year OR the city council may again ask for us to choose a permanant tax. To me, it seems that if NO to permanancy wins out this year, it’s unlikely that the council would risk losing that cash on a push for permanancy next year. If that holds true, then next year would likely be an ask to simply renew the existing tax for a set period of time, afterwhich we would vote again to renew or repeal.

The conversation about city budgets, infrastructure, sprawl, growth, development, and redevelopment is one that is increasing in importance. All have impacts on our city in a variety of ways that are now coming to light as the continue to impact the needs and efficacy of our public safety departments, which are far from perfect in implementation according to internal reviews cited earlier in this article.

Regardless of whether we vote YES or NO on this issue this year, no funds will be immediately lost. We would simply vote again in 2017 whether or not renew the tax as we usually do before it expires.

However, a NO vote would mean next year’s special election on the issue would mean the difference between continued funding from this source and imminent loss of about 10% of the pubic safety budget beginning in January of 2018.

That would mean a pretty massive scramble by leaders to come up with extra cash or would force local government hands to make cuts elsewhere. However, the threat of that loss would allow those unhappy with recent tax increases to voice grievances to, perhaps, open ears of city leaders who would be facing the tax revenue loss if the vote to renew the 1/4% tax in 2017 should fail.

A genuine discussion about our city’s growth goals, initiatives, funding, and the implementation of those plans needs to take place. In the meantime, you must choose to vote.

Should we make it permanent? Or should we revisit this sales and use tax on a regular basis?